Smart Info About How To Become Chartered Accountant In Canada

Money and the world virtual conference 2022.

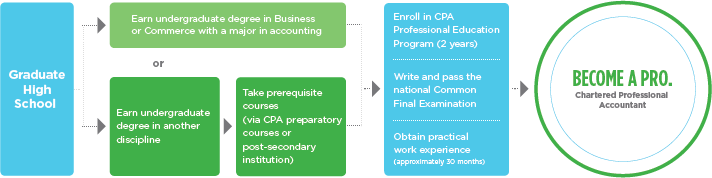

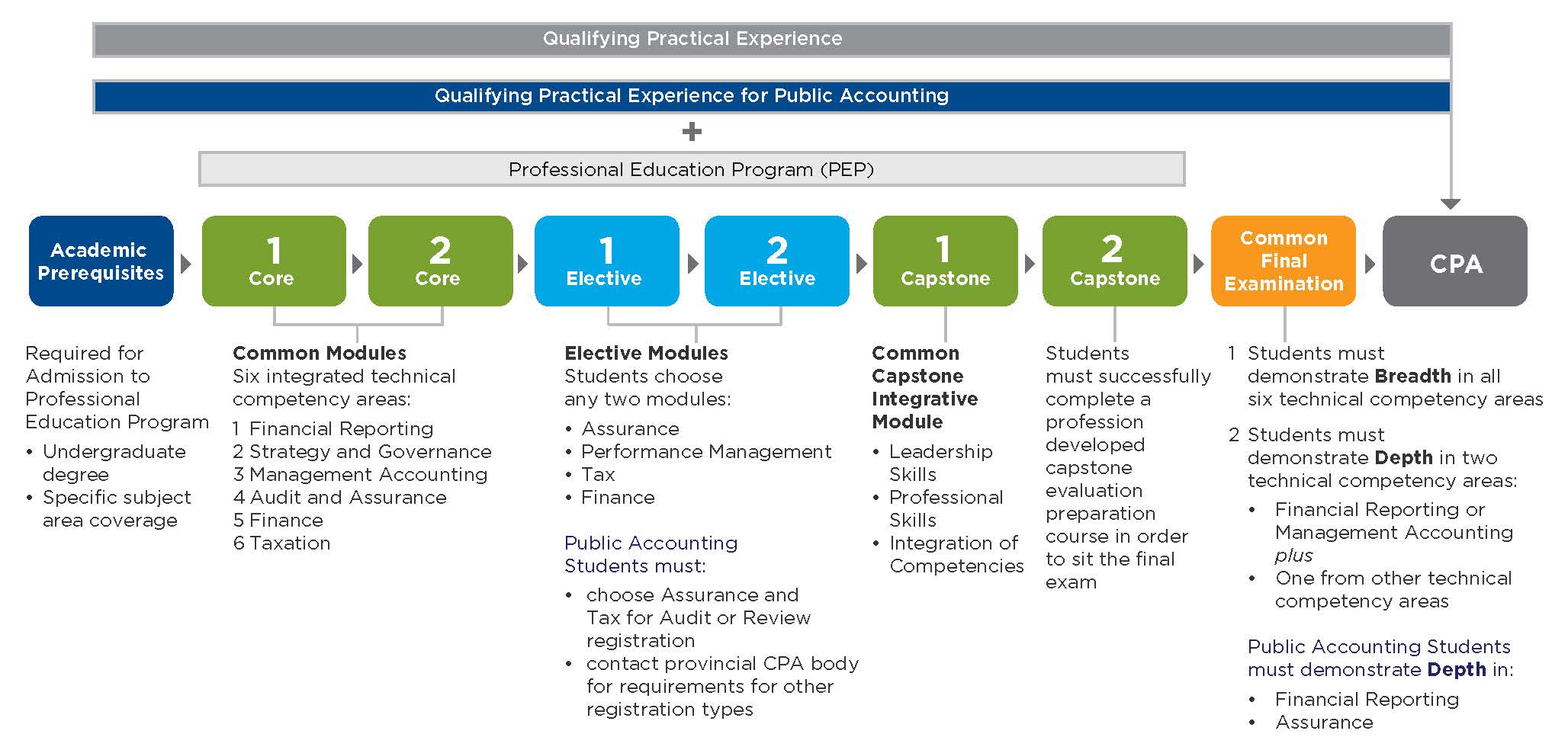

How to become chartered accountant in canada. There are two approaches to becoming a chartered professional accountant in canada. Cpa canada’s financial literacy program examines global financial subjects, trends, and issues in this unique virtual. Plus, you must pass two learning modules, capstone 1 and 2.

Enrolling the cpa professional education program is a great way to advance your career as a cpa. Prerequisite undergraduate education consists of earning a bachelor’s degree. How to become a chartered accountant in seven steps.

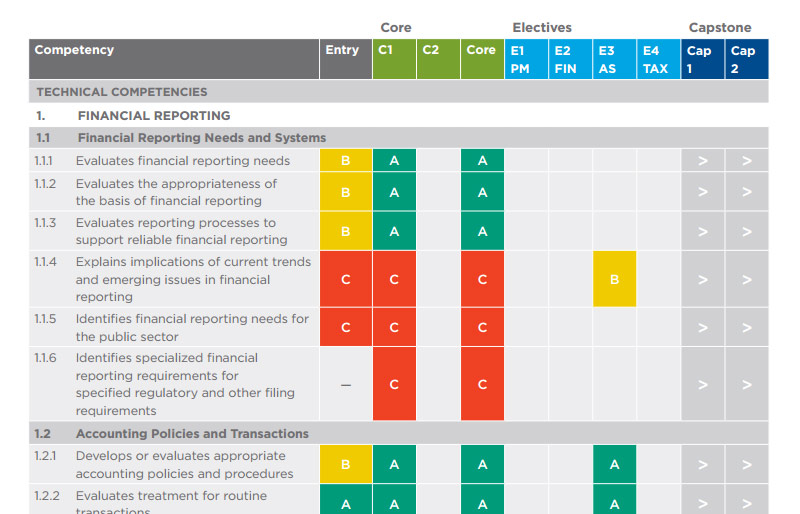

You need to provide proof of at least 3 years of business, accounting or other work experience, show proof of good standing with your. You will have to sit for six exams in the core modules 1 and 2 and two exams for electives 1 and 2. To pursue cpa certification, first ensure you meet cpa canada's.

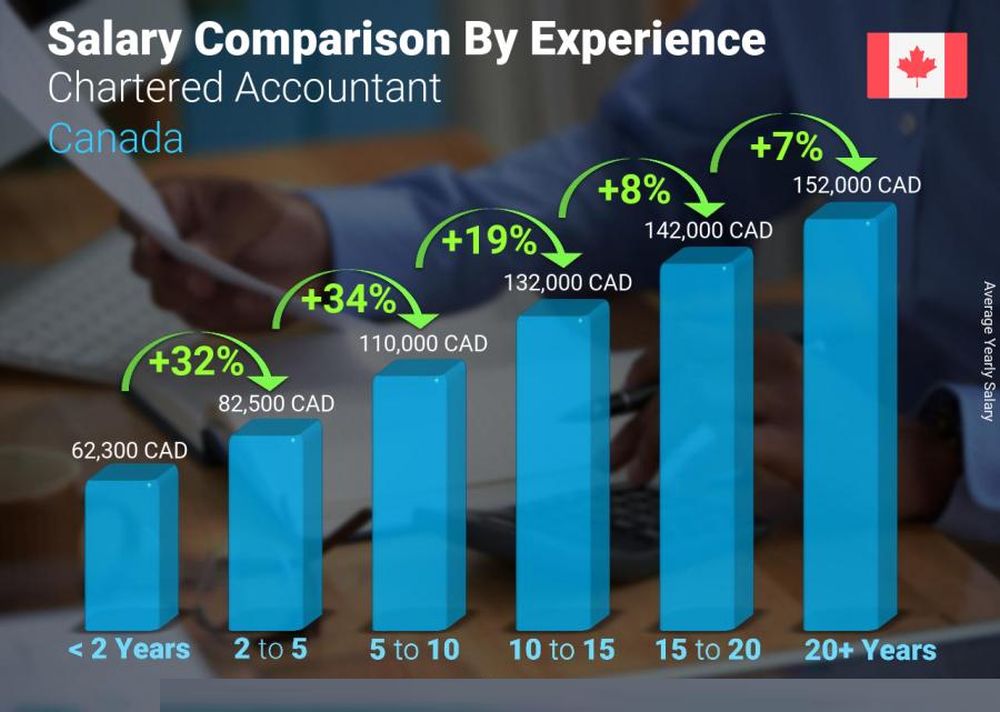

However, this may not be compulsory, but necessary. 30 months of relevant accountancy experience is required. Obtaining a bachelor's degree from an accredited program is the first step in becoming a chartered accountant.

The first, and most common, is to obtain an undergraduate program in a relevant field. Earning the designation requires the. Are you interested in becoming a chartered professional accountant (cpa) in canada?

How to become a chartered professional accountant (cpa) 1. Obtaining a bachelor's degree from an accredited program is the first step in becoming a. Ca foundation course, ca intermediate course and.

:max_bytes(150000):strip_icc():gifv()/TermDefinitions_Charteredaccountant_finalv1-8514f65bb8cf4b8685f7b2e8d8554c5a.png)

/CGAAccountant-56a8302e3df78cf7729ce42d.jpg)