Cool Info About How To Apply For A Tax Exempt Number

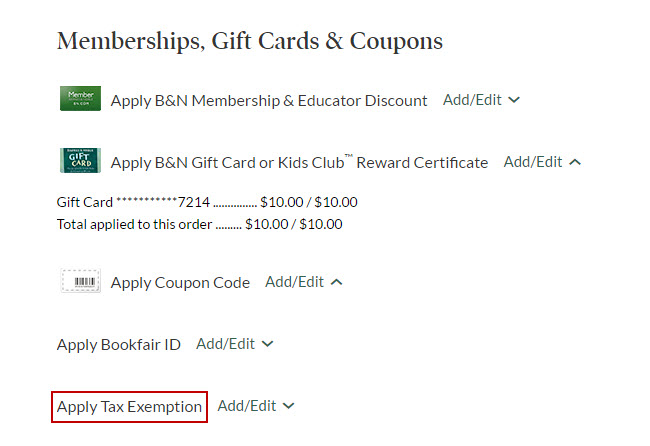

On the “account profile” page, scroll down to “company details”.

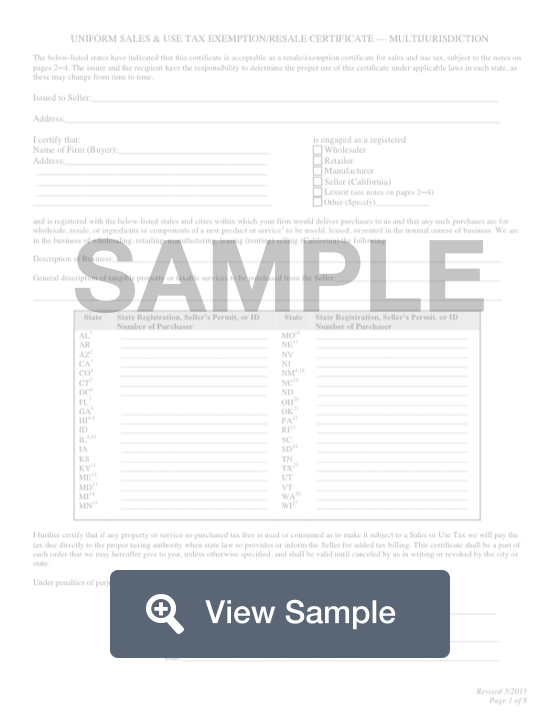

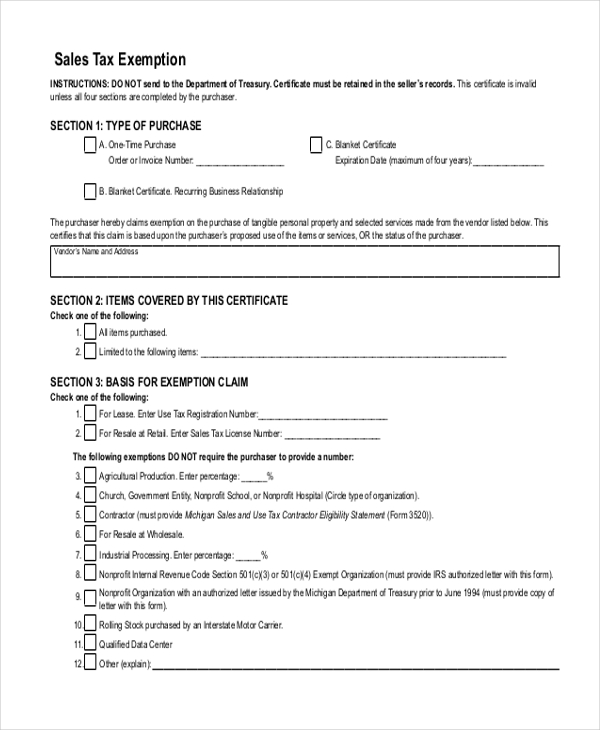

How to apply for a tax exempt number. If you qualify as a tax exempt shopper and already have state or federal tax ids, register online for a home depot tax exempt id number. Four forms currently used by the irs are:. Most organizations applying for exemption must use specific application forms.

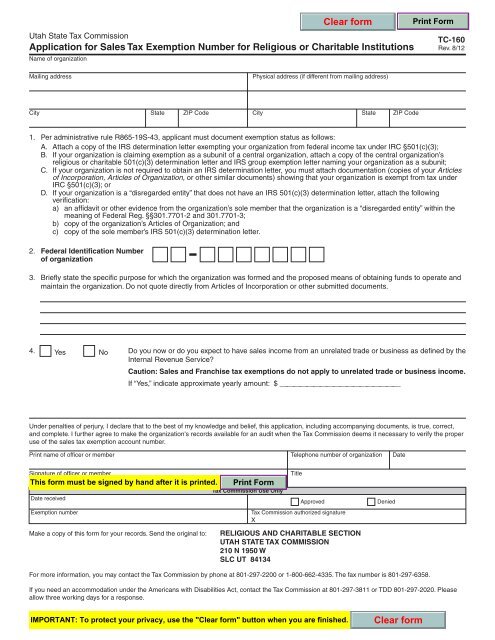

Most recently completed form with the application. The federal identification number and organization name must be entered on the application. Complete the application for sales tax exemption for colorado organizations ( dr 0715 ).

The seller fraudulently fails to. A seller is not relieved of its liability to collect and remit the applicable wisconsin sales or use tax on a sale to a purchaser if any of the following apply: Enter the legal name of the institution.

Determine if your organization is one of the following: To ensure you are able to view and fill out. You can apply for an ein online, by fax, by mail.

Establish your tax exempt status. A partial exemption from sales and use tax became available under section 6357.1 for the sale, storage, use, or other consumption of diesel fuel used in farming activities or food. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (ag/timber number) from the comptroller.

As of january 31, 2020,. International applicants may apply by phone.